WHAT IS THE SITUATION LIKE TODAY?

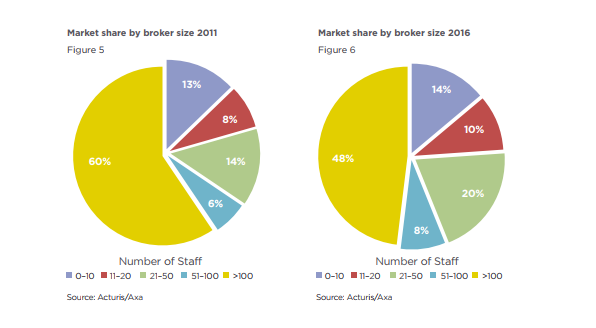

The following chart represents the share of the brokerage market, by number of employees, where the bulk goes to brokers with over 100 employees (who also run the largest clients, multinationals and monitor their businesses worldwide). However, the most interesting information is that the third place is held by brokerages with up to ten employees, which means that a significant number of clients recognize the quality that comes through smaller teams and their ability to quickly adapt and respond to their clients’ needs.

A gap in skills development trend is something 81% of brokerages are aware of. It is those brokerage companies that quickly fill the gap and reach the level of skill development, while maintaining the level of technical knowledge, will become the new leaders in the insurance market. The decline in the level of deep, essential, fundamental technical knowledge is what most companies are exposed to as millennials enter the workplace. At the same time, hiring practices need to change in order for brokers to attract new intelligence – a generation of millennials into their ranks.

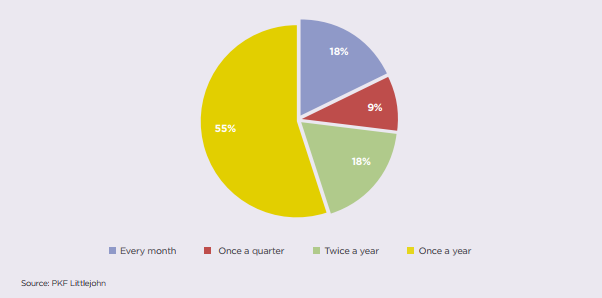

The following chart discusses broker-client communication, from which we can see that the frequency of contact follows the dynamics of premium payment. This means that brokers in the EU are still focused on product-price parameters, and in most cases they are yet to transform into an advisory role and dynamically monitor their clients’ businesses through insurance.

CHANGES THAT ARE NECESSARY

In the future, what awaits brokers, instead of contacting the client once a year – when it comes time to renew insurance contract, is a focus on the client’s long-term goals and quality support for client’s business development through intelligent risk management solutions. Brokers will elevate their communication with the client above the price and product levels to the level of comprehensive risk perception in the advisory interview. Advisory services will become more complex, qualifications will increase, and brokers will communicate professionalism to clients and among themselves. It is the quality of the advisory service that will differentiate the brokers from each other.

In terms of communication, digital channels are increasingly important. As many as 79% of those who are engaged in sales, and are using social networks to generate new customers and create opportunities for sales, are also more successful than their colleagues who ignore this tool. Maximizing the opportunities that come from using digital communication channels relies on three strong pillars:

- Professional brand

People, before engaging in insurance-related communications, look at personal profiles of employees (responsible) as well as company profiles on networks. Strong brands stand out, in the digital world, as much as in personal contact. The task of brokers is to make it easy for people to find them online and to develop a strong personal brand.

- Communicating knowledge

Insurance brokers are already spending considerable time talking to clients, in order to give them valuable and meaningful information and thus increase their expertise. Traditionally, this information has not been used enough, and new opportunities to share knowledge and experience with clients and colleagues coming through thesocial networks such as LinkedIn will strengthen their impact. This way, brokers will build their influence, attract new clients and retain existing ones.

- Relationship building

Social networks are a specific way of communication, connecting people (even in business-to-business communication) in a special, quite personal way. Insurance brokers who want and are ready to use this potential should systematically address the quality of the content they broadcast and how that content connects their audience.

Clients will increasingly expect brokers to understand their business, while for brokers, on the other hand, the process of reaching new clients will become a more dynamic challenge than it has been today. It is up to brokers to add value through their services and to impose and identify themselves as knowledge leaders. Also, customers will expect, and even imply, to see a professional brand online. With regard to the dynamics of uploading new, quality content, even when they do not specifically expect it, clients have a developed latent need to see that new, quality content is being uploaded with a certain dynamic.

“The main task for brokers is to find the best way to influence the quality of how clients see them, in terms of what they can do for those clients.”

(References: https://www.insuranceeurope.eu/insurancedata);

Future of Commercial Insurance Broking Report)