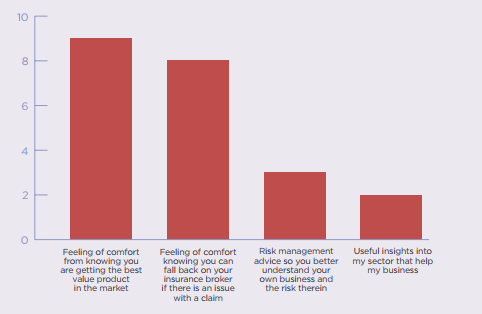

Top quality insurance coverage, redress support, risk management tips, a holistic view of a clients’ business and linking their business to insurance solutions, tailoring those solutions to their specific needs are what clients recognize as irreplaceable.

INSURANCE MARKET TRENDS

The insurance services market is undergoing intense changes in the process of digitalization and adaptation to new trends, new habits and tastes of future clients. The client of the future wants to get things done quickly and easily, „on the road“, without restraint and unnecessary procedures. This is a big challenge for insurers and the process of underwriting. The main issue for the development of e-insurance purchase is the question of the limits of the digitalization of the underwriting process. The products for individuals went through the biggest transformation, while the products that follow different business lines have not yet been touched by digitalization.

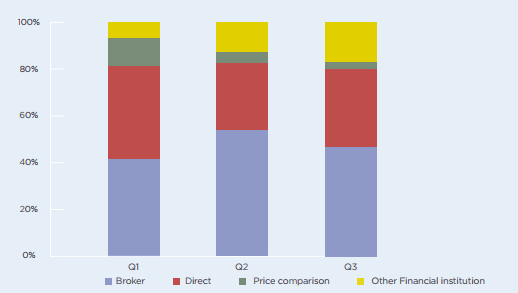

On-line insurance distribution channels are most interesting to the owners of small and medium entreprizes, as they are not burdened with procedures, while the SME decision-making process is most often reliant on the owner. The percentage of renewal of such insurance is very high and ranges between 75 and 80%.

However, there are also research findings that say there is not too much interest among SMEs in getting insurance directly. SMEs account for 40% of the total premium realized by brokers in the EU insurance market. However, we can distinguish this as follows: micro-businesses are more inclined to buy insurance through online platforms, while more complex SMEs still prefer the direct contact and continuity of relationships offered by a broker.

This is how the distribution by SME acquisition channel looks like:

INFLUENCE OF TRENDS ON INSURANCE BROKERS

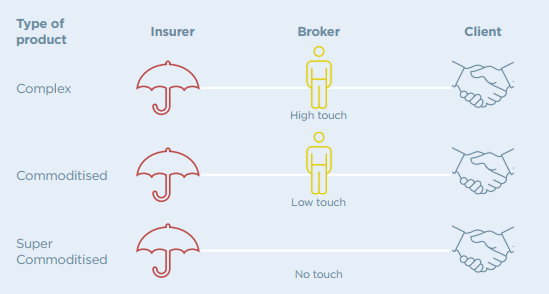

The more complex the requirement and need for insurance service is, the more pronounced is the need for brokers’ services:

In a situation where clients are unaware of the specific professional qualifications of a broker, it seems that the future of the brokerage business today, with a prospect of development until 2027, is still in the hands of the broker. Most customers value the most sense of comfort because they are aware that they will receive the highest value product on the market. Second in importance is the feeling that they will have someone to address when a harmful event occurs and that they are not alone with the insurer in the process. Then comes risk management tips and useful insights into what’s going on in a particular sector, and it’s useful for a specific business.

The improvements focus on simplifying processes and retaining clients. Brokers are future leaders who will lead through knowledge. They need to strengthen their service in the fields of consultation, risk management and knowledge-based recommendations, and leave insurance sales to insurance sales agents. This is exactly what, once again, affirms, clients value the most when it comes to the role of the broker: guiding the client through the insurance process and interpreting complex conditions in the insurance market while tailoring the offer to clients’ business. So whере brokers need to see and accomplish their development opportunity in the next, now less than ten years, is added value through a real understanding of the risks that accompany their client’s business, providing risk information and business risk management tips.

(References: https://www.insuranceeurope.eu/insurancedata);

Future of Commercial Insurance Broking Report)